Every sci-fi fan loves robots. Being a sci-fi fan myself, it is crazy to think that things I have seen in movies or read in novels are soon to be reality. How soon is debatable. Some say the technology is long ways away still, others think the social ramifications are what prevents robotics. When it comes to robots on a manufacturing line and doing simple tasks, we are there. In terms of an AI robot doing complicated things, we might have some work to do…

However, as I am writing this article, this news came out:

Tesla may have a functioning humanoid robot up and running within months, Chief Executive Officer Elon Musk said on Twitter, as he postponed the electric carmaker’s second AI Day until Sept. 30 for that reason.

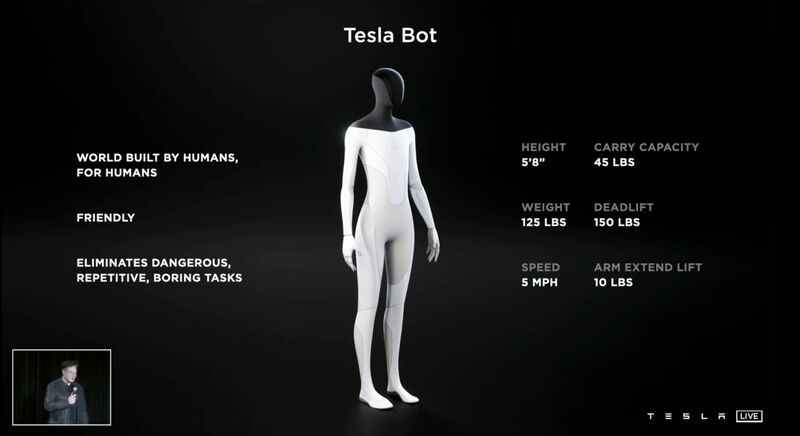

Optimus (Tesla bot), was first introduced in August 2021 during Tesla’s inaugural AI Day with that dance routine and is pictured above, is a human-sized robot Musk envisions will be able to perform mundane tasks like grocery shopping. Musk sort of has a history of hyping products up and then not delivering them on schedule. Regardless, he garners a lot of media attention and hype over this stuff. We shall wait to find out if a prototype does indeed appear by the end of the year. This may shift many people’s views and time frames on robots entering society.

I did mention the societal impact. I think this is important. Imagine going to university and paying a lot of money for a 4 year or more degree only graduating to find out you will be replaced by AI or robots quite soon. Imagine parents who saved money for years to send their kids to school and then realizing employment prospects have diminished because of technology. This is something that will occur and I don’t know if the world is prepared for it.

When it comes to robots doing repetitive and simple tasks, I think we are seeing signs of this increasing now. With inflation and the current labour market, companies and corporations may opt to implement robots rather than hiring people who demand higher wages. I went to a few local noodle shops in a suburb and I was surprised to see a robot on wheels bringing me my food and the card machine afterwards. It is already happening.

Here are three robotic companies traded on US exchanges that you should keep an eye on in 2022.

Guardforce AI (GFAI)

Guardforce AI is not just a robotics company. The company offers cash solutions and cash handling services in Thailand. The company’s services include cash-in-transit, vehicles to banks, ATM management, cash center operations, cash processing, coin processing, and cheque center services, as well as cash deposit machine solutions, such as cash deposit management and express cash services. They even recently signed a contract with Government Savings Bank in Thailand valued over $19 million over three years.

I just want to point that out before we jump into their robotics side of things.

The company has a rapidly expanding robots as a service business (RaaS).

Guardforce is heavily Asian focused, presenting its RaaS solutions at a hotel show in Dubai, and also offered a new bundled robotic disinfection service in response to the recent Covid outbreak in China. It does seem that Asian nations are more open to robotics and seem to be implementing them already. Japan and the UAE come to mind. Guardforce’s Asian focus makes it very appealing.

Last month on May 4th 2022, Guardforce announced they had deployed more than 4,800 robots across 9 locations worldwide including Hong Kong, Macau, Thailand, Malaysia, Singapore, Dubai, USA, Guangzhou and Shenzhen. These robot deployments cover various industries including, but not limited to government facilities, hospitals, hotels, tourist attractions, restaurants, sports centers, supermarkets, and transportation facilities. The integrated solutions provided by these robots include features such as disinfection, patrol, hotel check-in/check-out services (under testing), temperature screening, and advertising.

The most recent press release from Guardforce is also robotics focused. The company announced a letter of intent (LOI) to acquire 12 additional robotics companies in China. The twelve robotics companies are among the leading providers of Robotics-as-a-Service (RaaS) solutions within their respective markets in China and bring established customers and management teams. The 12 companies are located in key economic areas across northeast, northwest, central and southwest China. Most of the provinces served are among the top 20 markets in China for overall economic performance in 2021.

The total deal value of the target acquisitions is US $18.0 million, which is based on one-time projected average revenues for the twelve companies over the next 5 years. The acquisition is expected to be paid for with a combination of cash (10%) and restricted ordinary shares of the Company (90%) at the previously agreed price of U.S. $2.00 per share.

The stock is fairly new, IPO’ing in the US in September 2021. The technical pattern is catching my attention. We did hit an all time record low at $0.3016 before bouncing to $2.00 per share. We are now basing and developing one of my favorite reversal patterns. It looks like an inverse head and shoulders pattern is forming. The most important thing is we need a breakout to trigger this pattern. We do not get that until we get a daily candle close above $0.7300.

Until then, we can continue to range. It does appear that the psychologically important number of $0.50 is acting as near term support here. The past two weeks has seen GFAI hold above. If we manage to break below then we could retest $0.40 and then previous record lows. A bottoming is looking likely, but I am just waiting for that breakout to trigger the reversal pattern.

Myomo Inc (MYO)

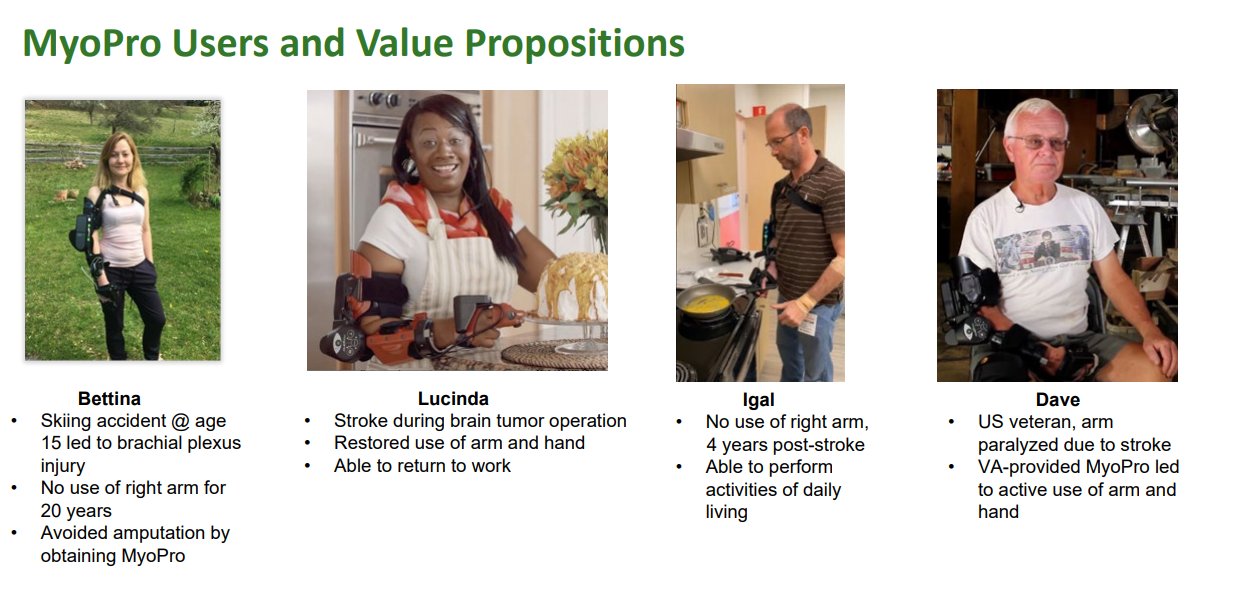

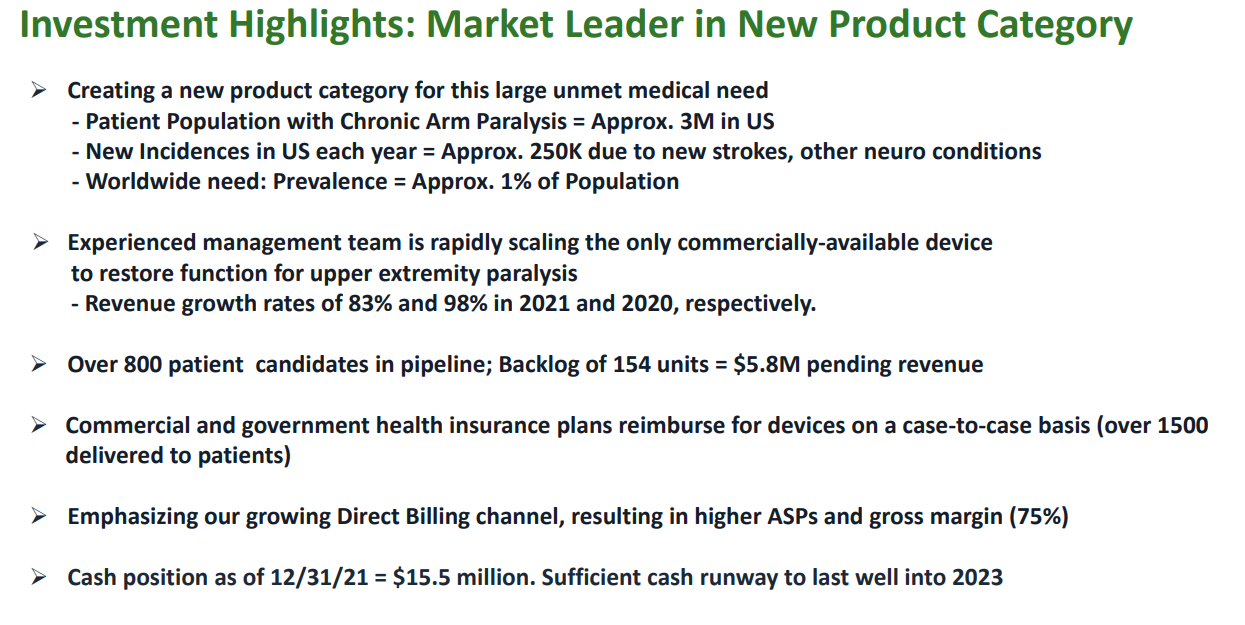

Myomo is an interesting one. The company developed MyoPro, a powered orthosis (brace) that may help regain function in arms and hands paralyzed by a stroke, brachial plexus injury, cerebral palsy, or other neuromuscular disease or injury. It is currently the only marketed medical device that may restore an individual’s ability to perform activities of daily living.

For sci-fi fans, it’s like an exo-skeleton.

Not the prettiest chart to look at. The stock isn’t having a great 2022. We just recently printed new all time record lows at $1.97. The good news is that there is a possibility of a reversal. Still a few things I would want to see. Besides prices looking to climb above my moving average, I really would like to see a break and close above $2.55. In technical analysis lingo, this would take out the current lower high. Or simply, it would take out the level which needs to be taken out in order to end the current downtrend and begin a new uptrend.

Microbot Medical (MBOT)

Microbot Medical is a pre-clinical medical device company, engaging in the research, design, and development of robotic endoluminal surgery devices targeting the minimally invasive surgery space. It specializes in transformational micro-robotic technologies, focused primarily on both natural and artificial lumens within the human body. Microbot’s current proprietary technological platforms provide the foundation for the development of a Multi Generation Pipeline Portfolio (MGPP).

The company is building the world’s first disposable endovascular robot.

https://vimeo.com/672502887

The company is still working on pre-clinical trials. At the end of March 2022, Microbot medical filed its pre-submission package for the LIBERTY® Robotic System with the U.S. Food and Drug Administration (FDA), addressing the regulatory pathway for the LIBERTY® Robotic System. The Company expects to meet with the FDA following a normal review process to discuss the pre-submission and ensure the testing protocols and regulatory pathway are aligned with the FDA to obtain clearance for LIBERTY.

“The significant progress we achieved in the first quarter demonstrates the team is highly focused on delivering key milestones on time,” commented Harel Gadot, Chairman, CEO and President. “The pre-submission filing with the FDA is an important milestone, and although it is the initial phase in the regulatory process, it gives us the confidence to commence implementing plans to scale up the Company’s organizational infrastructure to support future commercial success.”

The stock has made moves recently. We bounced nicely at the $4.50 support zone. We even had a 11% plus day on May 27th 2022. Momentum seems to be stalling at $6.00. If we can get a close above $6.00, then I would be interested to see if we can climb above $6.50. That is the resistance I am watching. The stock seems to have built a nice base at $4.50, and a new uptrend could be just beginning. A major catalyst for this year will be that pre clinical trial.