In my opinion, journalism – actual journalism – isn’t just about reporting what you see that’s wrong in the world, but working to get the things that are wrong.. righted. Telling people a building collapsed is easy. Reporting on the press conference that follows is ‘phone it in’ stuff. But talking about it every day until the rules change so the situation doesn’t repeat, that’s far more important – and usually not done.

An easy example of this would be the Watergate scandal, which would never have seen US President Richard Nixon resign from office had the journalists that broke that story not followed up for actual years on what happens next.

Journalism isn’t complete on the first story. You need to right the wrong, and be prepared to yell about it til that happens, and remind the public where necessary that they should still care.

I posted a thread to Twitter this week that used a certain public company to illustrate what I think is a problem in the public markets, which is ‘abusive cheque swaps’. I didn’t name the company directly or tag their ticker or quote a CEO because, realistically, they didn’t do anything heinous, they just pissed me off bragging that everyone in town was doing that deal and I’d be an idiot if I didn’t too, and it’s frankly been a refrain I’ve heard more and more of over the last few years.

I didn’t make the cut with that team because I wasn’t prepared to put in $120,000 to get a $40,000 deal. I moved on.

But a year later, that deal was hurtin’ for certain, even though it was hitting deliverables and, for mine, that opening rise and ensuing drop was the reason they couldn’t get love from the punters. It was their reputational anchor, a year later.

THE CONTEXT:

For those who don’t know, for many years, market awareness companies (like mine) would seek out public companies that were usually new to the market, usually raising money, and offer our services getting the word out to Johnny Investor for a set fee. Nothing inherently wrong with that business – in fact, any CEO who doesn’t market themselves in an effort to stand out agtainst 2000 other ticker symbols should be let go for incompetence, but there’s also a lot of scope for abuse.

Because most newcos want to blast out of the gate quickly and hit the ground running, they’re often wielding fat marketing budgets right before they list, and they’re quickly encircled by a greasy legion of sharp-suited d-bags fronting companies named with some combination of words like ‘business’, ‘financial’, and ‘network’, who are looking to empty out said budget by ‘going to the Germans’ or buying a fat online SEO native advertising campaign or getting a bunch of CEO video interviews out on Youtube to an audience of bots.

That’s the public stuff – the stuff that nobody gets in trouble for.

Go deeper and you’ll find the real assholes – the ones who’ll say, “hey shoot me a million shares and I’ll get my phone guys on it” or “if you don’t shoot me a million shares, I’ll get my short seller accounts on it.”

Deeper still, you’ll find the guys who take money from pubcos and just.. leave. No work done. No shame at all. Then they turn up at the next VRIC looking for more victims while their last victims seethe from the sidelines because, what are ya gonna do, go to the cops? File a lawsuit? Report it to the regulators?

The sharks know there’s no penalty for what they do, because even the most egregious exploiters of the markets take literal years to get investigated, let alone tried, let alone convicted.

As an example, see the Bridgemark scandal.

Graeme Wood at Glacier Media is literally the only journalist other than me who bothered to talk about this after the first piece was published, and he’s doing god’s work.

The commission alleged those in the case conspired to buy shares in private placements of 11 junior B.C. companies. They then allegedly received lucrative pre-paid consulting contracts only to quickly sell the shares back to retail investors on the open market and not perform any substantial work to improve the companies.

In 2018, three dozen marketing groups were given notices of hearing on this issue. By 2021, all but four had been discharged.

The Bridgemark guys are still doing deals. I’m told even they’re surprised nothing’s come of it all, though the two people remaining – Anthony Jackson and Justin Liu, have managed to delay proceedings a few times.

Jackson will be in front of the BCSC folks on the 20th of this month.. maybe.

WHY THE SHARKS ARE BAD BUSINESS:

Aside from getting in trouble with the feds once in as while, the ‘blow it up on day one’ routine is just a horrible market strategy.

Here are some reasons why:

- When the promo guys have all that stock in your company, they don’t ‘believe in you’, they’re not ‘putting their money where their mouth is, ‘they’re loaning you money in return for that marketing fee. The moment the stock is free trading, not only will they take that money back by banging out their paper (at any price, since you already gave them their money back), they’ll short your shares because they know the price is about to go down.

- You’ve got basically four months to prove to those guys they shouldn’t take their profits, which is a super short time for most companies at an early stage to lock in their business model. Even if you hang in there, they’re going to sell stock to execute cheaper warrants (which they got free in the financing), which they’ll then be on the clock to sell off in four months again.

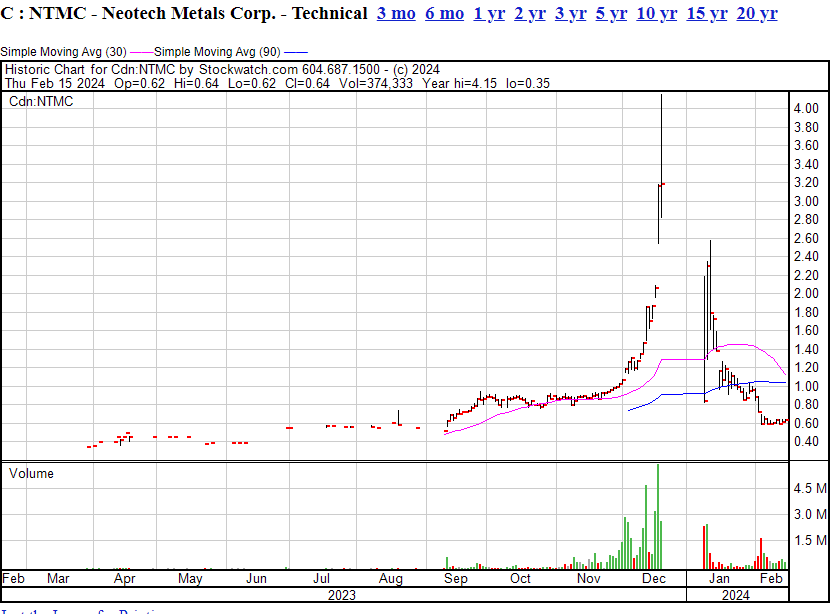

- The heart attack chart: For a year after the ‘big rise and ensuing fall’, potential investors will look at your chart and say “what happened at the beginning to make it drop so far?” Worse, they won’t ask at all, or do any research – they’ll just assume, rightly or wrongly, that it was a pump and dump.

- When you need money again – and you will – those same guys will sell their stock and/or their initial warrants to buy in, because they’re going to get MORE warrants and keep selling you down.

Congrats, you went from $0.80 to $1.30 to $0.70 in two weeks, and to $0.40 in a month, and to $0.20 in a year.

Now what?

And yo – Johnny Investor – yeah, you reading this – you’re not any better.

Throw a rock at a new public markets CEO and you won’t hit them, because they’re surrounded by giant cans of shit pretending to be marketers and, over time, the retail investor crowd has moved away from ‘do your own due diligence’ to ‘how much are they putting in promo?’ which makes CEOs even more susceptible.

As I said in my Twitter thread, that’s just the beginning.

- The exchanges let the brokerages buy your trade info before it’s executed so they can let the algorithms loose.

- The brokerages sell you to deal guys who put together sometimes questionable deals for early stage cheap stock.

- The deal guys sell you to the issuers who are desperate for a shareholder base, for a 7.5% finder’s fee, and cheap early paper, and dip out while you’re still in, and insist on the fat marketing budget so they have time to get out.

- And the issuers look around while their pockets are being picked and retail is calling them up all angry because the promo guys lied and the feds aren’t even on the clock unless the crimes are at Bridgemark levels of brazenness, and even then they take FIVE YEARS to get to a courtroom and let 90% of the bad guys walk, or lay fines on them that are assessed at low levels ‘to encourage payment.’

My business is helping companies find investors, so this doesn’t help me financially to say but those companies should actively avoid doing fat marketing programs on the launching pad. When it doesn’t work, it’s brutal to see, but when it does work, it can be far far worse.

Consider NeoTech (NTMC.C), which bought a $50k patch of scrub next to Defense Metals’ (DEFN.V) Wicheeda project, raised a million-plus and put it all into German promo claiming ‘we might be as good as Defense Metals’ and went to a $150m market cap with no work done, no resource, and a two-week long halt from regulators for taking the piss – while the project they were referencing was worth just $40m.

Guess who got out first.

HOW IT SHOULD BE:

I once got a call from the BCSC to go meet to talk about my business. I showed up, answered literally five minutes of questions, left happily and have never heard from them again.

"What's your disclosure look like?" It's on every page. "How do you handle stock options?" Don't take them. "What about shorts?" Don't do them. "What about buy/sell recommendations?" Don't do them. "Show us your contract." Here you go.

I’ve never, ever, in my decade-plus in this business had a call from the regulators since, or the exchange, or the polis, demanding I prove that I’ve done the work. That’s because my work is out there, all public, all over-delivered, properly contracted, disclosed, out in the open, and sometimes it’s even rough on the client because journalism.

You want to show you’re above board, ask a client CEO why he should still be the CEO – on video – and put it on your website.

Audiences know I won’t sell them out. They know I never short. They know I’ll hold stock longer than they will, even at a loss, because I want to be respected, believed, and in business for 25 years, and that’s my moat. You can’t compete with me on integrity because I’ve got a ten year start on you.

Every sales meeting starts with, “we’re the cleanest cats in town.”

Every editorial meeting ends with “no shit leaves the shop.”

That’s me. But how should the rest of the market operate?

MY WISHLIST:

Accredited marketers: Make us show our work, follow a code of conduct, obey a set of guiding principles on trades, and inspect our work. If we obey the rules, we get the big green check, and those that don’t are banned.

Accredited investors: The fact that private placement financings are gatekept by outdated ‘for wealthy dudes only’ rules means those who can bring accredited investors can force pubcos to do things they shouldn’t. The solution: Let any investor BE CERTIFIED accredited if they do a two-day course giving them a deep education on the markets that will help them do due diligence and avoid risk. Overnight, brokers would go back to building their books again instead of just taking a piece of everyone’s deals.

Enforced program minimums: Make every market awareness deal be for six months minimum, not 4 days, not two weeks, not a month. SIX MONTHS. Tie those guys to the company long enough for the company to find its feet, and put a trade hold on all stock that lasts until program end.

Attach the marketing to the company website: Every pubco has a news section on their site. Time to add a ‘marketing’ section so we can see exactly what’s being said in their name, at their expense – even by ze Germans – and make the company properly justify it. Spent $200k and only got one youtube interview? We should know that without you having to threaten a public lawsuit. Gave the brother of the director $7k a month for social media consulting? Let’s see his work.

Regulator Flying Squad: The regulators need a team that will spot market malfeasance and quickly act. Instead of sending a letter to the board asking for documents by March, halt the stock til they provide them, on any suspicious move. Uptick three seconds before the close of trading? Expose them. Insider might have neglected to mention they made a big sale yesterday? Expose them. Less lawsuits and ‘requests’, more action.

No more band-aid solutions: I see you, TSX-V, banning all cheque swaps and thinking guys who don’t follow the rules will suddenly follow the rules. The day after you passed that rule, a CEO suggested I “open a numbered company and buy the stock from that company.” I also see your ‘IR guys need to file a PIF’ rule that defines anyone who writes about a stock as an IR guy. Baby, you’re doing it all wrong.

ANYWAY:

The aforementioned CEO who pissed me off a year ago, who I used to kick the initial Twitter thread off but who honestly didn’t deserve to be singled out, called me up and said, “You know what man, I quickly learned a lot from how our company hit the public markets, and filled the room with real operators who’ll hold us to a high standard. Guys who’ll call us on our mistakes and keep me focused, and that’s made all the difference, and I don’t need you to take anything down, I just want you to know we’re out here doing the work,” and I fucking respect that.

That’s how you close the journalism circle – not by burying a guy, but by ensuring he’s doing the work.

Anthony Jackson will be facing the gavel next week. Graeme Wood will be there.

Let’s close the circle on the guys who really need to be closed out.

— Chris Parry

FULL DISCLOSURE: We are a Defense Metals client and may buy stock in the open market. If any of the above has pissed you off, it’s because you see yourself reflected in it and you’re the problem, and any issuer who isn’t prepared to face hard questions as part of their marketing should think hard about what that means.