Shares of Facebook parent Meta were down more than 23% Thursday after the company forecasted weaker-than-expected revenue growth in the next quarter. Losing about $210 Billion in market cap in one day. First quarter 2022 outlook was even weaker, raising concerns regarding the company’s growth.

Facebook missed earnings estimates for the fourth quarter at $3.67 vs. $3.84 analysts were expecting, according to Refinitiv. But it beat on revenue for the quarter, at $33.67 billion vs. $33.4 billion estimated. Revenue forecast of $27 billion to $29 billion for the first quarter fell below analyst expectations of $30.15 billion.

Facebook reported 2.91 billion monthly users in the fourth quarter, representing no growth from the prior period. The social network is feeling the impact of increased competition for users’ time, and a shift in interest to video where advertising isn’t as lucrative.

After earnings were released post market yesterday and the stock crumbled, a lot of traders are saying this is Netflix all over again! Another one of the FAANG stocks taking a hit. Oh, and tons of memes on Twitter about Facebook trading like a crypto alt coin and a value stock now.

Memes aside, Netflix bounced a few days later. Will the same occur with Facebook?

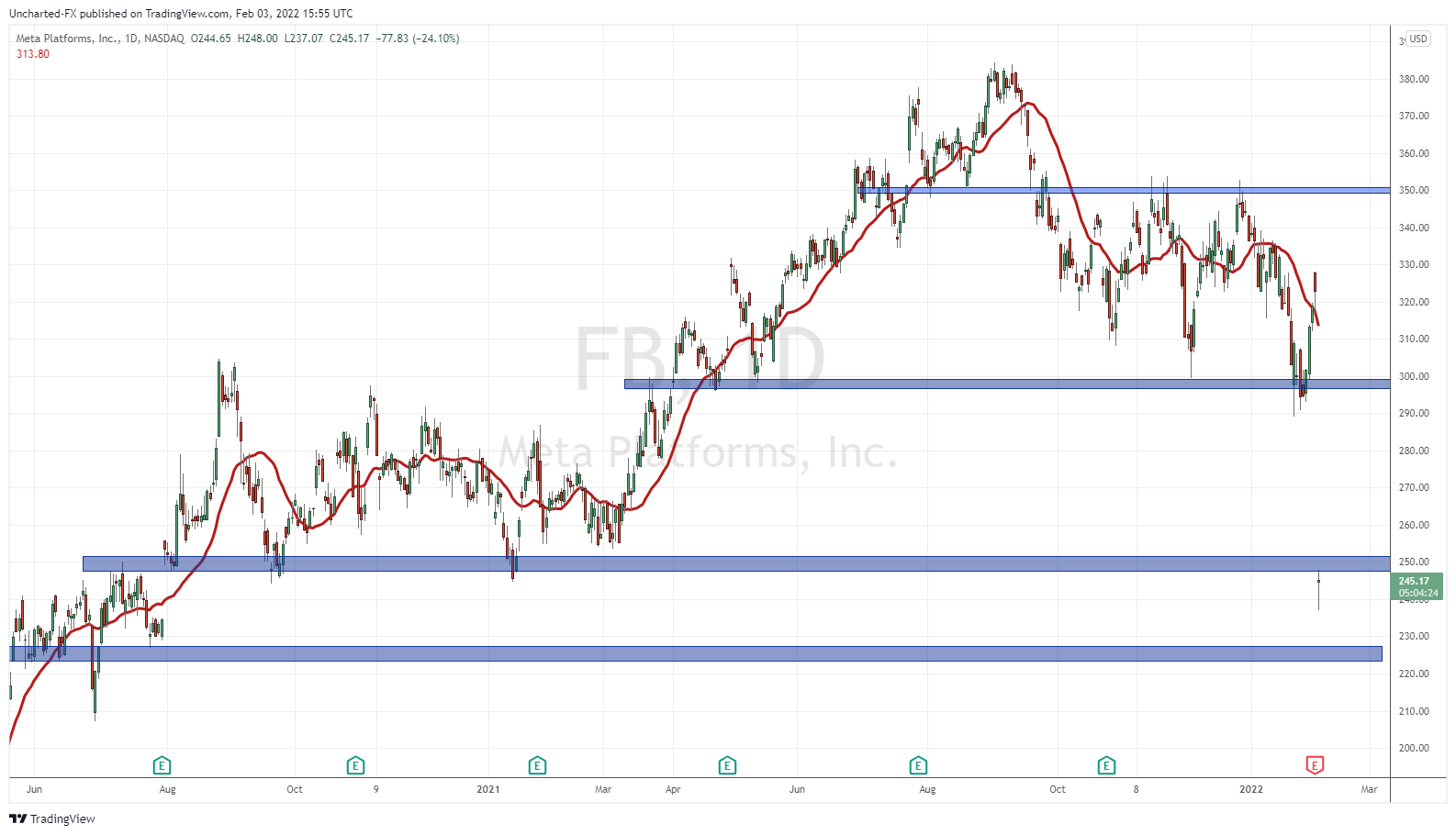

A huge gap down today. The stock closed at $323 yesterday and opened at $244.65 today. For us technical traders, we took out two major support levels. Yikes!

The $250 zone is the important inflection point for us to work with. If Facebook can climb back across, we will have regained this support zone (now acting as resistance), and can then begin to make a push up to $300.

If the opposite happens, and buyers cannot take price above $250, then a move lower to support at $225 is possible.

But I am definitely watching $250. Take a look at Netflix:

Same structure, and Netflix battling to regain $390 is just like Facebook trying to regain $250. Perhaps we can see a few days of range here before the breakout.

In terms of the stock markets, it is quite crazy how one company’s earnings are enough to bring down the markets. Personally, I think there are other factors in play. Mainly interest rates and inflation. The Bank of England hiked rates by 25 basis points to 0.50%. This was widely expected, and the FTSE declined. Watch this because the US markets may react the same way since rate hikes are widely expected.

Growth stocks tend to do poorly when interest rates are beginning to rise. Although, with all the cheap money, one can make a case for all stock markets to fall under pressure. The battle between how many rate hikes are possible will continue. Already talks on mainstream financial media about whether the Fed can raise in a weak economy (disappointing Retail Sales and ADP employment data) and if rate hikes would then therefore cause a recession.

Over in Europe, the Bank of England and the European Central Bank are determined to take action to combat inflation. The Bank of England has begun raising rates…the European Central Bank is a different story since they are in negative interest rates.

The Nasdaq has fallen on the open, but still remains in my no traders land zone. As long as the Nasdaq remains below 15,600 another lower high swing is possible, meaning we could take out recent lows below 14,000. Some bears are saying this lower high is being confirmed right now with the swing at 15,200. If the Nasdaq remains below 15,000 today and in the next few days, then perhaps we will be visiting 14,000 again.