Kontrol Technologies (KNR.NE) provides energy efficiency solutions and technologies to commercial energy consumers. It offers SmartSite, a building energy software technology to assist in the operation and management of complex heating, ventilation, and cooling systems for factories, large multi-residential, commercial, and mission critical buildings; SmartSuite that connects into existing building automation systems and also communicate with utilities; and BioCloud, a real-time analyzer designed to detect airborne pathogens for various applications, such as classrooms, retirement homes, hospitals, mass transportation, offices, break rooms, and others defined spaces.

BioCloud technology is designed to detect airborne viruses and pathogens. Maybe you can think of a reason why this is important today, and will be important as years go by. BioCloud has been designed to operate as a safe space technology by sampling the air quality continuously. With a proprietary detection chamber that can be replaced as needed, viruses are detected, and a silent notification system is created.

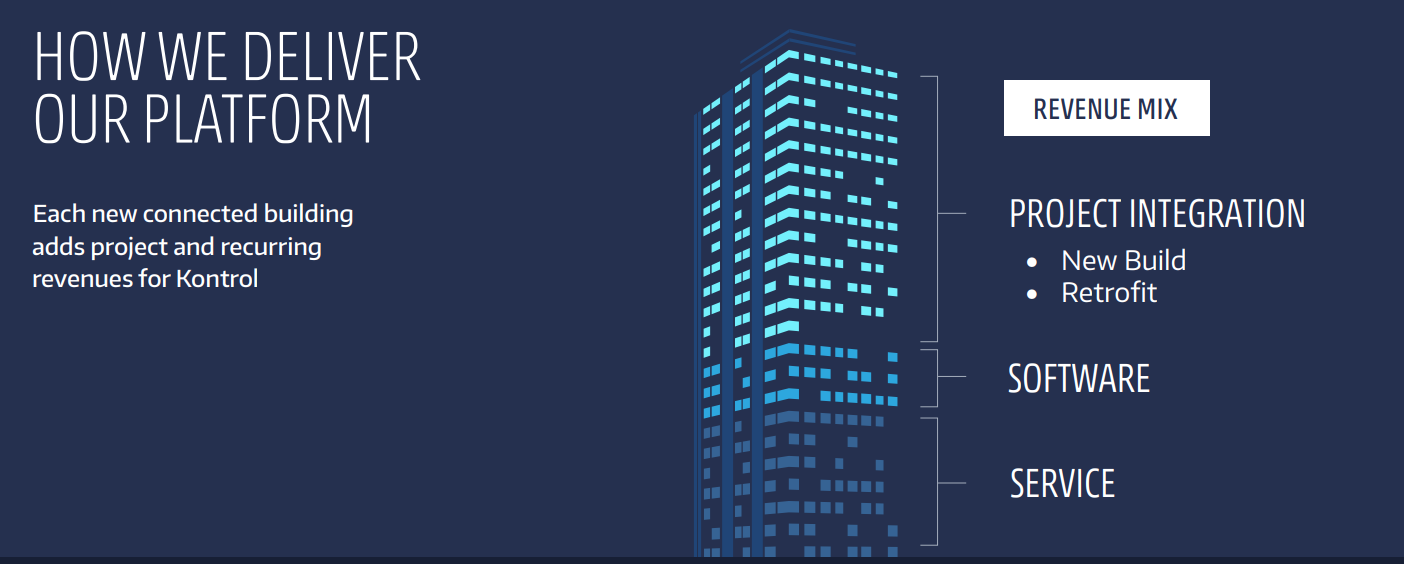

If you are into smart cities and smart buildings, then Kontrol Technologies is the company for you. Putting the BioCloud stuff aside, the green movement is real. Carbon credits are already becoming a huge market, and reducing emissions will be a government policy in the near future. Autonomous buildings that are smart, clean and sustainable is Kontrol’s forte. Kontrol’s overall aim as a company is to integrate smart energy devices, energy software and energy retrofits to help organizations benefit from energy cost savings while minimizing greenhouse gas emissions

The customer base? Anyone who wants to reduce energy consumption, lower GHG emissions, and create a safe and healthy space for employees, customers and stakeholders.

For you footie fans like me, Kontrol Technologies was selected by Bundesliga team VFL Wolfsburg to provide real-time air quality and viral monitoring. Remember, this team is owned by Volkswagen.

Recently, the company has expanded their BioCloud technology customer base to three other countries. BioCloud units were shipped to distributors in Qatar and the Czech Republic as part of existing distribution agreements.

A well-established trading company in Japan has also partnered with Kontrol Technologies. Kontrol and the trading company are negotiating a distribution agreement and are currently working together for technology demonstrations in the region. A distribution agreement is anticipated to be completed in February 2022. The trading company will not be named for industry competitive purposes.

For investors, there is a major catalyst coming up with a Health Canada testing update. The final phase of BioCloud testing is anticipated to be completed in February 2022, and testing is being conducted at the request of various government agencies. A government angle here and deal has the potential to be huge. Honestly, the future looks bright for Kontrol Technologies and their services.

So what do I see on the technicals? As of now, the stock needs to do some things for me to go bullish. Kontrol Technologies was holding a range from August 2021 until January 2022. We ranged between $2.00 and $3.00. In early January 2022, we tested support and investor’s hoped we would bounce like the multiple times we have done in the recent past. This is why I still wait for technical confirmations and do not buy or sell exactly at support or resistance. A trader can for sure, but I look for confirmation to increase the probability of my trade.

We broke below support which coincided with the overall sell off in stock markets. Very volatile markets, but things seem to be on the verge of shifting. The S&P 500 is close to testing my 4500 zone. If we can close above this, then I expect other indices and stocks to follow along and neutralize any downtrend.

For Kontrol Technologies, I would want to see a break and close back above $2.00. Regain what was once support, now acting as resistance. If sellers decide to pile in at $2.00, as they tend to do when support is retested, we could continue the downtrend if the sellers bears beat out the bulls. $1.00 is my next support zone. But let’s hope that is not the case. Stock markets are very close to confirm that all this volatility was just a pullback. If so, Kontrol Technologies can easily climb back across $2.00 and has a major catalyst from Health Canada upcoming.