It usually takes a pubco longer than six months from listing to take on a financing that sells the house to pay for the backyard, but that’s what happened recently with Northstar Gaming (BET.V), a Canadian online gambling provider that has gone through three years of bad financings in less than one.

PLAYERS ‘PLAYED’ FROM DAY ONE

Fresh out of the gates with their RTO in February, BET took some $12 million from a large multinational gaming company called Playtech in return for mucho equity. Not much wrong with that, happens all the time. A big player like Playtech coming in early should have been seen as a badge of honour.

Fun fact: Playtech bought an Australian slot machine company called Aristocrat eight years ago, which I interned for as as a 16 yr old design student. Good people, fueled by scotch, such were the ways of the time. If you ever played a slot called Desert Rally, I did the face plate design for that back when cut’n’pasting meant actually cutting and pasting drawings. Anyway, apparently the lesson here is I’m older than Baghdad. Let’s move on.

The folks running BET were believing their own PR early on in 2023, doing deals everywhere. BET gave away more equity a few months after listing, this time to the Abenaki Council of Wolinak, for their Spreads.ca gambling site, while they were also cutting a cheque for $55k every month to a capital markets advisory firm. That was all happening at around $0.40 per share, back in June. Heady days.

THE HOUSE LOSES:

By the end of that month, things were getting shaky. Playtech came in for some top up money, with over $1 million essentially serving as flow-through dollars, in that the dough was due to be used on marketing BET to potential gamblers later in the year.

In an effort to lose some preferred stock debt, BET converted a million bucks worth to common stock, and with paper now flying about like confetti on deal after deal, management was soon having to buy up the stock themselves on the open market to try to keep it from sliding too fast. They weren’t rich enough to succeed. The moment the Playtech top up was announced, the stock cratered.

At the beginning of August, it was down to $0.18. By the end of August, it was at $0.12.

So management went back to pappy Playtech with their hand out, and agreed the bigger fish would pony up another $10 million, with half of that going to stock and warrants, and the other half being a convertible debenture for three years, paying 8% interest, to be paid in, you guessed it – more stock.

TO BE CLEAR: Debt isn’t an awful way to finance growth, as long as two conditions are met:

1) Interest rates are low, which they’re not.

2) You’re close to break even, which they’re not.

By the time the Playtech deal v3.0 closed at $0.17.5, three weeks ago, the big fish now owned 48.42% of the company on a partially diluted basis, and BET agreed to put up half their boardroom seats under Playtech’s supple, designer-dressed asses.

It may not surprise you to hear that BET is now down more 2/3 from that financing, sitting at $0.055 at the time of writing, down around 85% from the heady opening days of its public opening and leaving insiders and management very much underwater on their own holdings.

Yes, Northstar has some cash now. But Northstar is bleeding out like a diabetic in a hot bath full of razor blades.

I apologize for that one. It even grossed me out.

THE DEAL DETAILS:

- Increased Ownership and Influence: The completion of this $10.3 million financing deal has resulted in Playtech acquiring a large number of common shares, A and B warrants, and a convertible debenture. This has elevated their ownership stake to approximately 27.53% on a non-diluted basis and 48.42% on a partially diluted basis.

- Board Representation: As a result of this deal, Playtech now has the right to nominate up to four individuals to Northstar’s board of directors. They have already exercised this right by appointing two.

- Strategic Investment: Playtech’s involvement is described as part of its continuing strategic investment in the company. This suggests that Playtech sees significant value and potential in Northstar and is keen on playing a more active role in its operations and future direction. That said, it’s managed to just short of take over what was essentially a $90 million company earlier in the year, for $20 million, while also being owed interest payments AND a kicker from BET if the marketing money they provided brings in any new users.

- Future Intentions: Playtech’s statement indicates that they intend to continuously review their investment and may make further moves depending on various market and economic conditions. This suggests that Playtech could potentially increase its stake further, depending on how things evolve, which would essentially see them take over, without having to pay a premium to do so.

ROLL THE DICE?

Don’t do it.

I saw deals like this repeatedly in the old cannabis days, where big funds would offer the preverbial hookers and blow to CEOs if they’d take on debt, knowing full welll the borrower would struggle to repay it, only for that debt to be used to snap up assets on the cheap as soon as other borrowing avenues dried up. Death spirals abounded.

Investor chatrooms and messageboards aren’t short of ‘investors’ claiming the current bargain basement price for Northstar is a great value pickup, but – and excuse me for being a bit on the nose here – Playtech is the bully at the table, and they hold all the cards. Playing penny slots at their casino is no way to get rich.

To take over control of the Northstar business, all Playtech needs to do is exercise warrants or wait for interest to roll in.

To go full take over, they could offer $0.10 a share tomorrow and likely snap up almost all of them, for less per share than their recent financing, while wiping out the debenture, leaving the ticker symbol behind, and taking all the assets back to London.

The average retail investors buying up stock, expecting Playtech to grab the company by the collar and propel it forward, are kidding themselves. The last three days have seen over 11 million shares traded in massive volume sell-offs, executed at the low.

It should be noted, Northstar lost $4.1 million in the last reported quarter, leaving it with just $1.2 million in cash before the hail mary raise with Playtech – with almost $1 million of that needing to be held in customer deposits. The cheapest warrants out there are at $0.21, so that’s not going to save them.

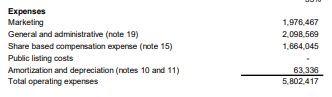

Neither are these expenses.

That recent financing deal was NOT negotiated in a position of strength, and means the company has a runway of six months before it’s out of cash once more with nothing left to sell.

UNLESS their casino site hits the afterburners over the winter, in a super competitive Canadian gaming market where nobody is making money yet, a ton of capital is being spent on marketing, most provinces are a closed shop, and legal customer money basically only shows up from Ontario.

And based on the reviews of their service right now, I can’t see that happening.

Ranked #61 in casinos?

I don’t have a dog in this fight but, I’m just a journalist and raconteur, I don’t short stocks and haven’t tried to do business with them but, ladies and gentlemen, you’ll have better luck walking away in profit if you hit the tables two drinks in than picking up this stock when it’s being taken down Playtech’s back elevator at 2AM.

— Chris Parry

FULL DISCLOSURE: No stock, no deal, no reason to lie.