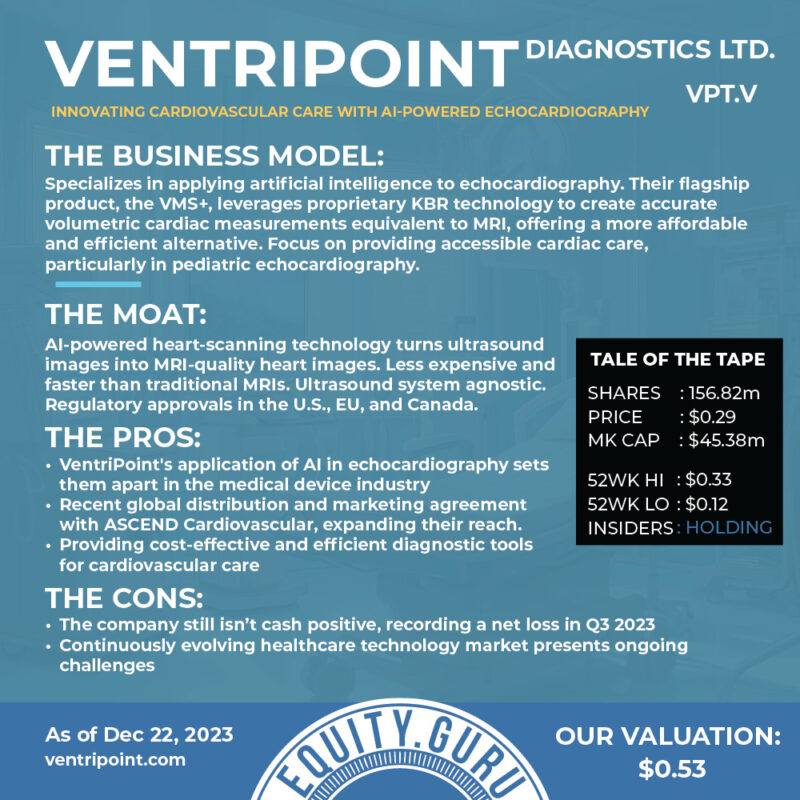

Heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups in the United States, costing approximately $239.9 billion in 2019 alone due to the cost of health care services, medicines, and lost productivity due to death, not to mention the emotional toll on patients and their friends and family. Therefore, to mitigate the fallout, effective cardiac care is crucial for both the management and treatment of heart disease, reducing mortality, improving quality of life, and preventing further deterioration of heart health. Early detection and accurate monitoring of a patient’s condition through MRI diagnostic sessions are essential to this process. However, MRIs clinics are relatively scarce and expensive, not to mention uncomfortable to the claustrophobic and potentially dangerous due to a remote possibility of explosion. Companies like VentriPoint Diagnostics (VPT.V) are revolutionizing the space with an AI-powered alternative to MRI heart scans that are safer, cheaper and produce faster results than traditional MRI.

VentriPoint leverages existing ultrasound technologies with the power of AI to produce MRI-grade imagery at a fraction of the cost. Ultrasound is far more prolific than MRI as even in the U.S. there are approximately 40 MRI units per million people. VentriPoint’s offering is technology agnostic and can run on ultrasound units manufactured by any vendor. In fact, the company’s deal with GE Healthcare gives it access to over 500,000 machines worldwide.

The company’s VMS+ and VMS+ Software for 3D Echo and MRI are advancing cardiac care in a significant manner, but the company is still in the formative stages as it continues to open its market. Currently VentriPoint boasts 4,000-plus leads in its sales pipeline with 25% of those leads being qualified. Considering that a recent study has found that MRI units pose the risk of explosion, dependent on a shrinking reserve of helium, and chemical tracers not entirely safe for infants and small children, it is not a stretch to imagine a grand replacement of these units as the hardware ages out for lesser invasive ultrasound if VentriPoint’s technology continues to prove itself.

What we think:

The next 12 months could prove to be parabolic for VentriPoint, but the company needs to continue to solidly execute on its sales pipeline. Their tech is transformative and provides a life-saving service that truly revolutionizing cardiac diagnostics. Once it opens its tech to a broader use-case diagnostic scenario, the world could literally be its oyster and investors may have a growth success story on their hands. As always do your due diligence and speak with an investment professional before making any portfolio decisions. Good luck to all.