Verses Technologies (VERS.NEO), a next gen AI company creating a foundation for the contextual computing age, announced today that it had put together a non-brokered private placement of 10 million units at $1.00 per unit for gross proceeds of up to $10.0 million CAD.

Each unit is made up of one Class A subordinate voting share in Verses and one-half of a Class A share purchase warrant.

Every warrant is exercisable into one Class A share at a price of $1.20 per share until August 15, 2025. The warrants may be accelerated if at any time prior to expiry the volume-weighted average trading price of the Class A shares on the NEO exchange exceeds $2.40 for a period of 10 consecutive trading days.

If these conditions are met, Verses may accelerate the expiry date to a date that is 30 days following the written notice to warrant holders.

Verses intends to use the proceeds from this raise to feed general working capital. The private placement is still subject to regulatory approval as well as a four-month hold period from the date of issue.

Shareholders can expect participation by certain company insiders in the announced private placement. Any such involvement will be defined as a related party transaction under the Multilateral Instrument 61-101.

This private placement will help fuel the company’s mandate of helping to accelerate the development and deployment of next generation AI applications focused on the Internet of Things (IoT) through the company’s ground-breaking COSM AI operating system.

COSM also provides the foundation for Verses’ flagship Spatial Web AI application, Wayfinder. Wayfinder is built to optimize operations in a warehouse, by analyzing a three-dimensional layout of the space and guiding warehouse pickers and automated operators along optimized routes in real-time, increasing productivity as much as 40%.

Verses is a foundational developer of spatial web technologies which integrate Web 3.0, Industry 4.0, Metaverse and IoT. The company will further cement its position with the anticipated launch of the COSM Exchange – a marketplace for connectors, devices, datasets, and AI models for third party services and developers.

News flow for the company has been strong, with deal expansions with major industry players and marketing partnerships with leading logistics consultancy firms.

The market has reacted positively toward Verses since its IPO in June as noted by Equity.Guru’s own Lukas Kane in a recent article.

Gabriel Rene, Verses CEO, spoke with both Chris Parry and Jody Vance recently in the following videos:

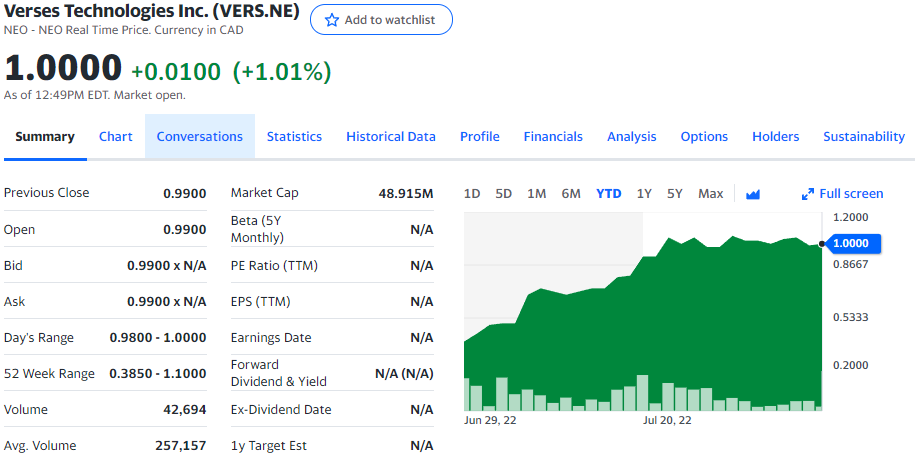

Verses currently trades at $1.00 per share for a market cap of $48.92 million.

–Gaalen Engen

Full Disclosure: Verses Technologies is an Equity.Guru marketing client.