Verses Technologies (VERS.NEO), an AI company focused on providing foundational technology for the contextual computing age, announced today that it had successfully closed the final tranche of its previously announced oversubscribed private placement securing total gross proceeds of $14.96 million CAD.

Each unit is comprised of one Class A subordinate voting share in Verses and one-half of a Class A share purchase warrant.

Each full warrant entitles the holder to purchase one Class A share at an exercise price of $1.20 per share until August 15, 2025.

The warrants issued in this offering are subject to acceleration if at any time prior to the expiry date, the volume-weighted average trading price of the Class A shares on the Neo Exchange exceeds $2.40 for a period of 10 consecutive trading days.

If this condition is met, Verses, at its discretion, may accelerate the expiry date to the date that is 30 days following the written notice to the holders of the warrants.

Proceeds from the private placement is slated for general working capital purposes. All securities issued pursuant to the third tranche of the private placement are subject to a customary four-month hold period expiring December 27, 2022.

Certain Verses insiders participated in the offering, purchasing an aggregate of 12,280 units.

In recent news, the company announced it had become a member of the Digital Twin Consortium®, an international organization dedicated to creating collaborative partnerships between digital twin users and experts working in industry, government, academia, and the tech sector.

News flow has been strong for Verses. At the end of July, Verses announced its strategic partnership with leading global supply chain management consultant firm, Tompkins Ventures.

Earlier that month, Verses also expanded its deployment of the company’s cutting-edge AI-powered spatial software with a globally recognized e-commerce fulfillment service company, NRI.

Verses’ business is based on the company’s ground-breaking COSM AI operating system, which allows programmers to build intelligent application for anything, and its flagship Wayfinder AI app, which improves warehouse picking activities by guiding workers and automated devices toward optimal routes, increasing productivity by as much as 40%.

The company reported $2.66 million USD in cash as of June 30, 2022, with $373,519 in revenues for the quarter ending at the same date.

Verses recorded a net loss of $8.88 million for fiscal 2022 ending March 31, 2022, largely due to the loss on the reverse take-over of VT of $5.35 million.

Equity.Guru’s own Chris Parry sat down with Verses founder and CEO, Gabriel Rene, to get a better look at the company, its value proposition and what potential it holds for investors.

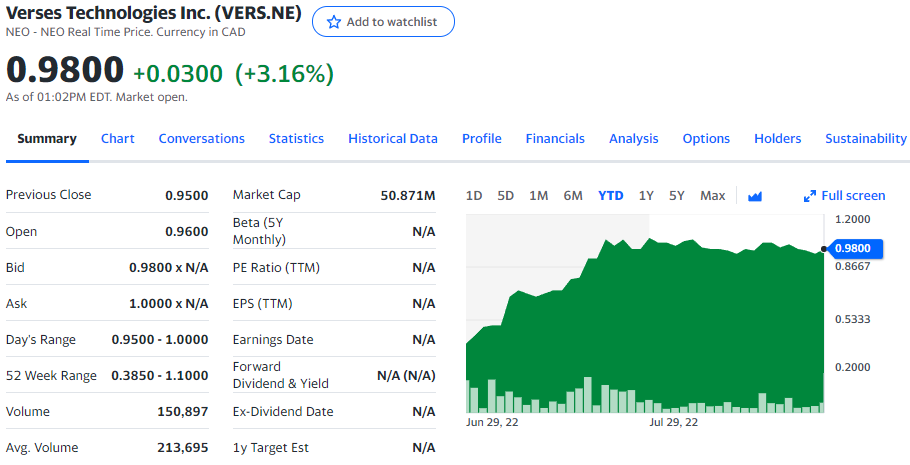

Verses currently trades at $0.98 CAD per share for a market cap of $50.87 million.

–Gaalen Engen

Full disclosure: Verses Technologies is an Equity.Guru marketing client.